Welcome back to The Stanza. This is the final Friday Weekly Digest I’ll be sending this year, and it’ll be free thanks to Peoplevine, supporters of The Stanza from the beginning. Comments section is also open to all.

Today’s newsletter will discuss trend predictions for wellness hospitality and luxury fashion in 2025 and beyond. I will be reporting back in a year with what came true / what didn’t.

My number one “prediction” is the shift from consumer spending on physical goods to experiences. I say “prediction” in air quotes because it’s a reality that is already beginning to manifest, as consumers increasingly value experiences over accumulating things. It was pretty clear from the luxury slump that only worsened this year. Former LVMH N. America Chairwoman Pauline Brown thinks that we won’t be seeing another growth market like China in her lifetime. Beyond the issue of China, the price hikes, distribution issues, and disillusioned customers, can be attributed to this one central problem: you can’t scale exclusivity. It’s fundamentally an oxymoron.

That being said, the thrill of shopping for fashion or other consumer goods won’t go away, but shopping habits are changing. Why spend $4K on a new bag when you can buy something cooler and unique on Vestiaire Collective or The RealReal for a fraction of the price, and travel somewhere amazing instead? There are a lot of ways luxury brands can embrace this shift to their benefit, but we won’t get into that today. Bottom line: I think boutique hospitality & real estate - whether that’s hotels, branded apartments, restaurants, members clubs, wellness clubs, etc - are well positioned if the operators behind the brands know how to reach and speak to their customers. And obviously, if they understand how to run a tight ship.

PS: If you’re a hospitality operator or real estate owner/developer based in the US/EU, please reply to this email and introduce yourself!

In today’s newsletter: Kim K stepping down from her PE fund, Erewhon’s clothing brand in Paris, Sak’s/Neiman’s, wellness clubs, luxury fashion & China

VISUALLY INTERESTING

WELLNESS HOSPITALITY TREND PREDICTIONS

Any video I posted this year discussing wellness hospitality was sure to get a lot of views and engagement, which tells me that it’s something you guys are all really interested in. Based on conversations with people in the wellness real estate space, here's what I’m noticing:

More dedicated social wellness spaces as sober and sober curious trend continues amongst Gen Z'ers

It's not news that wellness has been a growing category in a post pandemic environment. Given that an increasing number of young Americans choose to drink less or not at all, there are a number of existing and new clubs that are focusing on the social wellness experience.

More city hotels converting underutilized spa space into wellness clubs

These spaces have historically and generally been the least accretive businesses within hotels, but can be easily repositioned with some light capex and better branding, since most of the infrastructure is already there.

Too many new clubs started by inexperienced players

In the last month, I've spoken to 5 people who want to open a wellness club in their respective cities. It is a super hot category. Just like all trendy businesses, wellness clubs won't be immune to the dynamics of a bubble. Don't open one unless you have fully diligenced what you need to do to operate one efficiently, and definitely bring on an experienced team that can get you access to capital and other resources.

*Brought to you by Peoplevine, the best-in-class hospitality CRM software serving the top operators in the industry. Book your free demo here.

LUXURY FASHION INDUSTRY TREND PREDICTIONS

2024 was the year of slowing sales, unreasonable price hikes, stalling China, and the closure of several indie fashion brands. All of these events are leading to a renaissance of luxury fashion. Here’s what I’m seeing happening both from a consumer level and behind the scenes:

Access to culture as a status symbol over owning luxury goods

In the last market cycle, luxury brands have become overly accessible - there's an abundance of choice literally everywhere now and therefore no longer are exclusive or scarce. This is one of the reasons why global luxury has slowed down over the last year - it's no longer truly luxury if anyone can have it.

My entire platform is dedicated to the intersection of hospitality and fashion, and I think there is no better way to build a unique and rich world than to leverage hospitality, interior design, and experiential retail.

Natural selection

There are too many brands trying to be everything for everyone. For institutional brands, I think we'll be seeing certain product lines being cut or brands reducing exposure to certain markets.

Focus on profitability

Coming out of a low interest rate environment, companies and their stakeholders realize that they should focus more on the bottom line and drive repeat business instead of pure top line revenue growth. This will give brands a much stronger foundation that is less affected by hyper growth or decline, which we've now seen the consequences of.

Following up on that point, the industry as a whole has seen what happens when brands have viral products and can't keep up the momentum after, and therefore the industry will value steady and consistent growth instead of having a banner year or two.

This last point will be largely driven by the apparel M&A market, because prospective buyers will want to see a brand has longevity instead of being a flash in the pan.

The smarter operators will be focusing on what makes their brand unique versus trying to constantly chase trends or compete with the LVMH’s of the world, and will find a way to make it their moat. Additionally, for brands doing less than $500M in global sales, are fashion shows really worth the cost? Bottom line: the winners will think of innovative and different ways to speak to their consumers.

THE STANZA’S DEAL SHEET

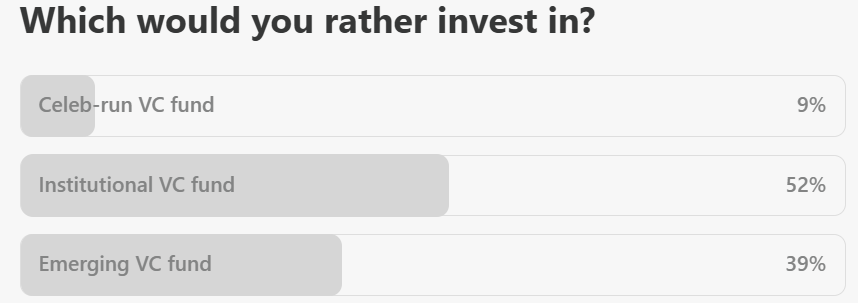

Kim Kardashian is stepping away from the PE fund that she co-founded with ex-Carlyle guy Jay Sammons, SKKY Partners. In the two years it’s been live, they’ve only raised $121M out of the $1B target and invested in 1 deal, Truff Hot Sauce. Coincidentally, in last week’s newsletter following the bullet about Jay Z’s VC fund, I asked you guys the following:

And given you guys are an intelligent audience, the poll results aren’t surprising. There are certain benefits to co-founding a fund with a celebrity: distribution, investor network, and deal flow. But all of these things are fickle these days as consumers are less likely to trust influencers/celebs, said celebs are prone to getting cancelled, and key man risk is top of mind in consumer M&A after a slow year. On top of that - if you’re starting a fund, then you probably have a solid network and deal flow already. All of these benefits can be found without giving majority ownership in a fund (or even just too much) to a celebrity that doesn’t know much about investing.

Sak’s completed its $2.7B acquisition of Neiman Marcus, with none other than Amazon as part of its cap stack (+Salesforce and Authentic Brands Group). The combined value of the retail real estate holdings is $7B. I wouldn’t be surprised if they converted some of their space into last mile fulfillment centers.

THIS WEEK’S CURATION

As someone who grew up in LA but has lived in Europe for most of my adult life, I always find the fetishization of LA culture abroad a bit funny. Recently, I’ve seen Italians travel to LA to post photos at Erewhon, like it’s a tourist destination. If you’re a reader based in LA, you’ll likely think that’s funny because that’s just where you go for your Sunday grocery shop or your weeknight hot plate on your way home from work. One of the biggest cultural differences I’ve noticed (and one that isn’t talked about enough), is how American consumerism drives pop culture abroad, and how much that’s taken for granted by its participants. Readers in LA: do you know what Esselunga is? Or Carrefour? Most likely, no. But, walk through any aisle at Erewhon and it’s completely full of brands that are likely backed by VC’s, packaging and branding done by the same handful of agencies, and similar marketing strategies on TikTok. The way that has become such a spectacle outside of LA, and outside of the US, is cool, fascinating, and scary to me at the same time.

In January, Parisian retailer Merci will begin stocking Erewhon merch - quarter zips, beanies, etc. I don’t know that this merits Erewhon calling itself a “fashion brand”, because merch isn’t fashion, but it’s notable that fashion multi brand retailers are trying to get a piece of the Erewhon zeitgeist.

Such a great point, Nadine—the wellness club space is definitely heating up!🔥 It makes me excited, nervous and puts a fire under my ass, but I LOVE it!

You’re so right about the operations! As we expand our wellness club to LA, we’re committed to building something sustainable and impactful. We’re currently on the search to bring on an experienced operator who has worked at members' clubs and understands the scale we’re aiming for with our LA location. Your insights are a great reminder of how critical it is to have the right team in place!

I also loved the poll on sauna/ice bath preferences—Private vs. Social! If there was a third option for a club that has both, I’d definitely be voting for that ;) Excited to see the results of this one! Thanks for sharing—you're amazing!💚💚

What's on your wishlist for wellness clubs? Ice baths? NAD shots?